Reinventing Myself

Hello everyone and welcome to the CavalRe! 🤠

In this article, I'd like to introduce myself, introduce the CavalRe, why we're here and what our vision is for the future of decentralized capital markets.

I am a bit of an unusual animal. By now, I have reinvented myself several times throughout my career starting over from scratch each time.

The Physicist

I started life as a physicist. I did my undergrad physics degree at a small local university because I was already a student there taking college physics and mathematics my senior year of high school and couldn't afford to apply anywhere else.

I supported myself through undergrad by tutoring physics and mathematics. If I tutored that day, I got to eat that day. If not, I didn't 😅 I survived on Taco Bell, Dr Pepper and Metallica to get me through the long nights studying. During that time, I found my talent for teaching. I became the most popular tutor and, at one point, was literally opening up lab rooms and charging students at the door to come hear me lecture because they said I explained better than the professors. It is hard to count the number of physical therapy students who got through their physics requirement with my help. I've loved teaching / presenting every chance I get since then.

Through sheer luck (and a decent Physics GRE score), I managed to get into UIUC to pursue a PhD in computational electromagnetics. While there, I worked with some of the best students and professors in the world. But man, did I suffer imposter syndrome those first couple years! How could a little kid like me from Fresno, CA deserve to be in a place like that with so many amazing people? My time at UIUC was transformational. The first couple of years, I worked harder than anyone else (and that is saying a lot because those guys are maniacs) fearing the university would find out I didn't belong there.

Eventually, I found my legs and started to excel at research. For my MS thesis, I developed a new isotropic algorithm for solving Maxwell's equation in inhomogeneous media with dramatically reduced numerical dispersion error. With this research, I won a highly competitive international student paper award and my work was cited by researchers in the US Air Force.

My PhD dissertation topic was extremely ambitious. One thing I loved about studying applied computational electromagnetics is that I could pretend to be solving practical engineering problems while secretly thinking about fundamental questions in physics. One thing that bugged me about most numerical algorithms is that there was a large element of art involved. When you discretize a physical system so that you can code it up on a computer, there are choices to be made and the choices you make determine the numerical performance of the code. A bad choice can lead to instabilities where all numbers blow up to infinity. There had to be a better way.

What if instead of starting with a continuum model involving coupled partial differential equations on smooth manifolds, you started in a universe where everything was already fundamentally discrete to begin with? If such a universe existed, its mathematics should be just as beautiful, if not more so, than the continuum models. This led me down a deep and beautiful rabbit hole involving algebraic topology and noncommutative geometry.

As the end of my grad school days approached (I didn't want to leave!) and it was time to start looking for jobs, my wife (at the time) encouraged me to consider working in finance. Apparently, math savvy physicists and mathematicians could get high-paying jobs on Wall Street. I honestly had no interest in finance. I wanted to spend the rest of my days contemplating the nature of the universe thinking about quantum mechanics and general relativity.

With a half-hearted "Why not?" attitude, I set up an interview at Citadel, a large hedge fund in Chicago. I didn't know the first thing about finance so I was surprised to learn that the person interviewing me was a former astrophysicist. We were 30 minutes into a great chat about general relativity and astrophysics when he asked me how I would model a merger arbitrage. A whatta whatta? 😅

I still remember his words:

Eric, I can tell you are a smart guy, but I've got a stack of 30 PhD resumes on my desk - all from top universities and all have some finance knowledge. If you are serious about working in finance, I suggest spending some time learning the basics. It will be easy for you and shouldn't take long.

I took his words to heart and started teaching myself stochastic calculus and something clicked. I (re)discovered a fascinating relationship between stochastic calculus and noncommutative geometry. This immediately created a bridge between my dissertation research and mathematical finance. I was sold. I am fairly certain I am the first person to ever use noncommutative geometry for derivative pricing.

By that time, however, I had already received an attractive offer from MIT Lincoln Laboratory, a prestigious research institution, to work as a physicist developing electromagnetic wave simulations for radar systems. I spent the next two years at MIT/LL but the seed had been planted. I used that time to continue teaching myself mathematical finance, while self publishing a few finance articles.

The Quant

My first reinvention occurred when I got my break in 2005 to go to Wall Street. I joined Citigroup's risk management team as a "risk quant", where we were responsible for modeling every asset class across all Citi's trading desks globally. This was great exposure, but was short lived. For personal reasons (baby on the way!), I decided to move back to California to be closer to my family.

A common theme throughout my career has been the need to make up new titles for me. After Citigroup, I joined the investment team at Capital Group, one of the largest investment companies globally with over $1.3T ("T" as in "Trillion") AUM. I wasn't supposed to even be considered for the job. I heard they were looking for someone with more than 10 year's experience, but my mentor-to-be insisted I come in for an interview because he had read some of my self published articles on noncommutative geometry and finance and wanted to meet me. We hit it off and 21 interviews later (I hear I got off easy - most CG new hires need many more interviews than that), I got an offer as a "Quantitative Research Analyst", which was a made up title just for me intended to be something between a "Quantitative Analyst" and "Research Analyst".

At Capital, I was part of an elite team called Capital Strategy Research working with economists, political analysts, currency analysts and even former ambassadors. We were the only group that could cross internal company boundaries because we were not involved in specific stock / bond selections. I had phenomenal exposure to all markets including the full spectrum of stocks to the full spectrum of fixed income from commercial paper, sovereign bonds, municipal bonds, investment grade corporate bonds, high yield corporate bonds, as well as structured products including ABS / MBS. Not only did we have great exposure to phenomenal investors and analysts internally, since we were in the top 3 trading volume with all investment banks, we had pretty much unlimited access to external executives and top economists. It was weird seeing people I just spoke with appearing on Bloomberg.

After two years being an absolute information sponge, I felt I was finally growing my wings and was able to formulate my own thoughts on the markets. Just in time for the global financial crisis! I remember being something of a Cassandra trying to convince the banking analysts that the balance sheets were completely fabricated. I was calmly corrected that the banks were well capitalized, but I countered, "Well capitalized based on what? I was building the models and my next job - if I had stayed at Citigroup - would have been to build a CDO model. That means there was $40T notional exposure in a market where risk models simply do not exist." As much as I loved Capital Group, the people and the culture, it was becoming clear that it was not the right place for me. Being a quant at Capital Group felt like being an alien from another planet.

From there, I made the colossally bad career decision to join the Fixed Income Research team at Countrywide just as the subprime crisis was beginning to unfold. I remember my new colleagues frantically trying to recalibrate the risk models because they would not even run if you tried to plug in a negative number for home price appreciation. All the risk models assumed home prices only go up! 🤦♂️ I remember having a laugh with a bright young quant about the parameter space of the risk model. I noticed a big part of the parameter space wasn't being modelled. He said, "If the markets move there, we don't need to model it because we won't be in business anymore." 😅

I think I was one of the last people brought in before the hiring freeze, but somehow survived the first round of (10,000+!) layoffs. That gave me some street cred with the other survivors, but the writing was on the wall. I got an offer to join an asset allocating quant hedge fund at TCW Group and asked my new boss (who remains a good friend to this day) if I should take it. He said I should and if I volunteered to be let go, I could receive a severance package. My last day at Countrywide was on a Friday. I joined TCW Group the following Monday and received my several package from Countrywide without missing a beat.

My time at TCW Group was super productive. I had a lot of freedom to build stuff. I completely revamped the asset allocation model and wrote a series of research articles for the rest of the group. Then my wife (at the time) became a victim of the global financial crisis and lost her job. She was in a complete panic. No one was hiring so I suggested she take a break and go back to Hong Kong to spend some time with her family. Within a week in Hong Kong, she got an awesome job offer so we moved to Hong Kong in 2009.

I got an offer from the first place in Hong Kong I interviewed, i.e. Harvest Global Investments (HGI). That was intense! For the first 9 months in Hong Kong, I did not take a single day off. I was working 7 days/week and averaging over 100 hours/week. HGI was like a startup. We were setting up everything from scratch, but we had a parent in Beijing. HGI is the Hong Kong branch of Harvest Fund Management, the largest asset manager in China.

After a rough year at HGI, we finally got all the systems and reporting set up, but on a particularly rough day, a recruiter cold called me. I wasn't looking for a job, but I said, "Why not?" and was introduced to the Head of Reporting, the Head of ALM and the Chief Risk Officer at ING Asia Pacific Insurance in Hong Kong. We hit it off. They liked my strong background on the asset side of the balance sheet and, again, made up a title for me: Regional Manager, Market & Investment Risk. That was my first experience with an "ALCO", i.e. an asset and liability committee, a C-level committee looking at risks to and opportunities for the insurance balance sheet. I was a key member of the regional ALCO and a regional representative on several local ALCOs.

Insurance is a curious industry. It is full of super smart people, but the bureaucracy, systems and tech infrastructure are completely dysfunctional. It is a testament to the people that insurance companies can operate at all. If there ever was an industry begging to be disrupted, it is insurance. Again, my time at ING was a lot like a startup because the bank and insurance companies had just split (a requirement following the bailouts) leaving huge vacuums on the insurance side, especially around credit risks that were previously handled by the bank. We had to create entire new functions from scratch.

After about two years at ING, we learned that market conditions were not supportive of the planned Eurasia IPO, so they would be selling the Asia business separately. We initially hoped the whole Asia business could be sold together, but they ended up selling the business units piecemeal meaning there would be no need for a regional office and my job would be disappearing. I contemplated my next career move. I always knew I wanted to try my hand with a startup at some point and I wasn't getting any younger, so I registered my first business: Coherent Capital Advisors in July 2013. Although registered, I was still on the fence about jumping into the life of an entrepreneur full time when I received an offer from AIA. I had been in talks with their Group CRO about becoming a Regional CRO, but that would involve a massive reorganization of the business and wouldn't happen any time soon, so as an intermediate measure, I became Head of Risk Management of the Hong Kong / Macau business unit.

In the short time I was at AIA, we did several good things, but one project, in particular, stood out. We built a new superfast strategic asset allocation model that took earnings and local statutory capital into consideration. We could perform balance sheet projects including solvency on the order of once per 200 ms (or 5 projections/second). This opened up avenues for exploration previously unheard of in insurance capital management. My boss, the CFO, presented our results at an internal CFO conference with 20+ other business units. Everyone raised their hands and wanted what we had built in HK. The project that started in HK grew legs and the Group CRO together with the HK CFO pitched the idea of helping me set up a business so I could come in and run this groupwide project as an external consultant. It would be easier for them than creating a new headcount and it would be more lucrative for me. I told them, "No need to set up a business! I already did." Coherent Capital Advisors was born with revenue on day one.

The Entrepreneur

As far as startups are concerned, I was spoiled with Coherent. We had good revenue from day one as a spin out from my role at AIA. As the groupwide strategic asset allocation (SAA) project evolved, I needed to start building a team so I met with the regional leader for SAA projects at EY to discuss resources etc. I didn't become an entrepreneur to build software owned by someone else. I wanted my own IP and I felt like EY would make a good customer because the kind of insurance capital management tools I wanted to build would help them better serve their insurance clients. So, after a few meetings, I brought up the subject and was surprised when Fred turned the table on me and suggested he join me and we do that together. Soon after, Fred convinced his friend Michael to leave PwC and I had a founding team for Coherent. Rather than source via EY, we decided to hire our own quant research and actuary staff. EY was not happy and I heard they almost sued us 😅

From 2014-2016, Coherent became the best ALM consulting firm in Asia, hands down, but I was never happy with consulting. I wanted to build IP. So there became something of a rift between me and my partners. I remarried in 2014 and my wife is from Philippines so I took a business trip to gauge how realistic it would be for Coherent to expand to Philippines and build a software development team there. On this trip, I met an awesome senior developer, Marvin. I invited Marvin back to HK to meet Fred and Michael and spend a week with us teaching us about software development. I was pumped. Coherent is expanding to Philippines! Fred and Michael were lukewarm on the idea, to say the least.

It is kind of ironic that one of the things that put a wedge between us was that I started talking about building a digital insurance company. Fred and Michael had no interest in that. It's impossible! Instead, they wanted to build web-based tools like "How much money should you give your parents?" "Should you buy or rent in Hong Kong?" I knew the answer to the second question: Who could afford to buy in HK?! 😅

When it was clear we were heading in different directions, I knew it was time to split up. My initial inclination was to send them on their way. I was still majority shareholder and sole director of Coherent. Coherent was my baby. My daughter helped me design our logo before they even joined. Things got a little emotional, but eventually calm prevailed. When I thought about it, if I sent Fred and Michael away, they would have to renegotiate the contracts with AIA because the contracts were with Coherent. As awesome as they were, it was clear to me they would not be able to get that done. If I booted them, the work with AIA would terminate (I had lost my interest in consulting) and they would fail. I didn't want them to fail. Being business partners is like being family. So I made the tough decision to basically give Coherent to them for pennies. Rather than value the company based on revenues, I simply took 1/3 of the cash in our bank account and gave them the business.

Coherent is still going strong today although all the original founders have left. Fred and Michael brought in John Brisco in 2018. They restructured the business and rebranded and have been doing great ever since under John's leadership. Occasionally they forget to acknowledge their roots though (no Coherent was not founded in 2018 😉), but I am happy to watch their success from a distance. I still consider it my baby although it has grown independently since 2016.

When I spun out Coherent Asia (CA) from Coherent Capital Advisors (CCA) in 2016, as the name implies, I still intended to remain sister companies. The idea was that I would build software and they would focus on consulting around the software. It seemed like there could be good synergy between us. Marvin became my CTO and Joseph was my COO. The big difference between CA and CCA was that CCA had revenue from day one, but to build software, we would need to raise some capital so Marvin, Joseph and I worked on a business plan, put together a pitch deck and started hitting conferences to meet with VCs. We found some early interest with a couple angel investors. We were talking about raising 10M investment now knowing that we would need at least another $40M and he assured us he could get it. It was surreal.

There were three conditions: 1. He wanted us to move to Bangkok and 2. He wanted majority control of the business. 1. was not so unreasonable and I was fine to move to Bangkok. 2. felt a little unusual, but this was Asia after all. It is not so unusual for tycoon-like investors to take controlling stakes of startups early on. I reluctantly agreed thinking I didn't mind having a small piece of a large pie. That turned out to be one painful mistake I will never make again. The third condition was that he wanted us to operate in extreme stealth mode so, unfortunately, I lost contact completely with Fred, Michael and CCA for two years from 2016-2018.

With hindsight, I made lots of mistakes with Axia (the name of the new entity with Coherent Asia being a holding company). One big mistake was operating as if I had the promised 40M on the way. When it came time to sign agreements, instead of paying 10M. The first year, he funded our $2M budget and I built a stellar team with operations in both Singapore and Bangkok. However, the agreement created a toxic cap table because he still wanted controlling shares so we entered into a complicated non-dilution agreement.

The following year as I was preparing the new budget, we received a bombshell. The VC could no longer support our operations and we had to scramble to find a new investor. By this time, we had built a beautiful business with a beautiful team and beautiful tech. We were deep in talks with regulators about licensing in both Hong Kong and Singapore and we had an awesome partner in Thailand who had already submitted our product to the regulator for a approval. We were literally months away from going to market. My team pulled together and we managed to get a term sheet signed with an awesome investor in Singapore for $5M at a healthy valuation. Unfortunately, we could not find terms that were acceptable to both our first investor and the new investor so the deal fell apart and we failed shortly after that in September 2018. That kicked off two of the worst years of my life.

The CavalRe

From 2018-2020, I was dealing with the fallout from Axia while also trying to get something new started. During the time, I had several false starts and I think the main reason nothing clicked was that I was deviating too far from my north star. I believe in efficient, effective and fair capital markets. If I am not striving to make capital markets better, I am not following my north star.

I still believe that insurance securitization can and will change the way insurance companies of all kinds manage their capital. So instead of trying to become an insurance company, build up a balance sheet and then securitize our own balance sheet, I decided to attack the problem at a different starting point on the capital management value chain and began working on CavalRe 1.0 in January 2020.

CavalRe 1.0

As the name implies, CavalRe 1.0 had aspirations of becoming a licensed reinsurer. In fact, we had early conversations with Bermuda Monetary Authority about joining the regulatory sandbox. I was hoping to take the best of all ideas I've had and create a reinsurer that also provides capital management software solutions to the cedant. This would realize two of the key objectives I hoped to achieve with Coherent Asia and Axia. I spent most of 2020 building traditional SaaS infrastructure to make this work and made considerable progress.

Unfortunately, around September 2020, I was headed toward a financial cliff and was forced to take up some consulting work and built the analytics for an investment dashboard of a large insurer which took most of my time up until around September 2021 when I was able to slowly start weening myself off the contract work and begin focusing on CavalRe again.

As I eased back into CavalRe, I noticed some new decentralized insurance protocols coming online. These protocols were saying the same things I have been saying for the past 10 years, but they were making it happen onchain. One protocol, Bridge Mutual, got my attention, but I struggled to understand how they planned to manage their capital. I started to work out an improvement and planned to actually just give it to them to help them out, but as I was thinking about how to do DeFi native insurance the right way, I had the proverbial "Eureka!" moment and I saw how concepts from automated market makers (AMMs) could be used to price illiquid insurance risks.

This led my down a rabbit hole researching the mathematics of automated market makers when I came across a beautiful survey article by Leo Lau and G.W. Xie:

A Mathematical View of Automated Market Maker (AMM) Algorithms and Its Future

Leo Lau, G.W. XIE at AnchorDAO Lab

I was initially thinking I could build a reinsurance protocol on top of one of the existing AMMs, but soon realized that existing AMMs did not constitute suitable primitives for what I wanted to do. It also bothered me that existing AMMs were not derived from solid financial principles. There was usually some invariant function postulated that is meant to incorporate the dynamics of supply and demand, but with little further motivation. To gain a better understanding for myself, I decided to try to derive the mathematics of AMMs from first principles in the spirit of the original derivation of the Black-Scholes equation.

I put away all the whitepapers and starting rederiving the AMM math myself from scratch.

CavalRe 2.0

The financial principles behind our new multi-asset self-financing AMM are not so complicated. We simply assume the following:

- The pool tokens are liabilities equal in value to the value of all asset tokens in the pool.

- There is a rebalancing strategy for the weights of all asset tokens in the pool.

- All trades are self financing.

From this, we can derive what I call the "liquidity curves" that capture the supply and demand dynamics of the AMM. With these results in hand, I excitedly tried to share them with anyone who would listen to me 😅 I had recently connected with Dave White from Paradigm and Leo Lau, the author of the beautiful AMM article above and was chatting with them separately when I asked if they'd be interested in forming a Telegram group. They agreed and Dave invited Dan Robinson to join. The group was created on October 23 last year. That was a fun couple of weeks chatting with them and I became convinced I was onto something new and cool. One day, Leo, was trying to follow my derivation and noticed that in one step I made a choice in how we define "self financing" and we could have made a different choice that would lead to a different AMM.

I was inclined to ignore that other case because it involved allowing traders to trade on stale prices, but Leo kept pushing me on it. If we take that other case seriously, then it means we have a whole one-parameter family of cases and each parameter value between 0 and 1 leads to a slightly different AMM. I was still inclined to ignore the other cases on financial principles ("You can't trade on stale prices!"), when Leo noticed that a miraculous simplification occurred if you set the parameter to 1/2. In this case, out popped the constant product formula made famous by Uniswap! 🤯

I was already planning to acknowledge Leo in my paper for asking a bunch of great questions, but when I saw that we could derive Uniswap's constant product formula from first principles, I knew we had to include that in the paper and Leo definitely deserved to be coauthor for his contributions.

The Paper

We quickly wrote up our paper and I wanted to publish it on the arXiv. The last time I published on the Arxiv was back 2004. The arXiv is not peer reviewed, but as a minimal spam deterrent they require authors to be endorsed by other authors so we had to find a sponsor to endorse us. Dan introduced us to Tarun Chitra and Guillermo Angeris to see if they could help.

Meanwhile, I reached out to Peter Carr. Peter and I crossed paths several times in the past two decades. He was interested in some of my early work on discrete (noncommutative) stochastic calculus and we had talked about writing a paper together. Peter was kind enough to endorse me and we published the paper on November 15.

A Family of Multi-Asset Automated Market Makers

Eric Forgy, Leo Lau

Sadly, not long after endorsing our paper, Peter passed away. We lost a great person and I'll always remember the kindness he showed me over the years always willing to help others.

The Protocol

At the time the paper was published, as I mentioned above, I was winding down some contract work that ended earlier this February. I have been 100% dedicated to turning our paper into a living breathing protocol since then and there have been a number of milestones.

I started writing the smart contracts in February and managed to get them deployed to an Ethereum testnet (Ropsten) and executed my first swap with the new AMM on April 6:

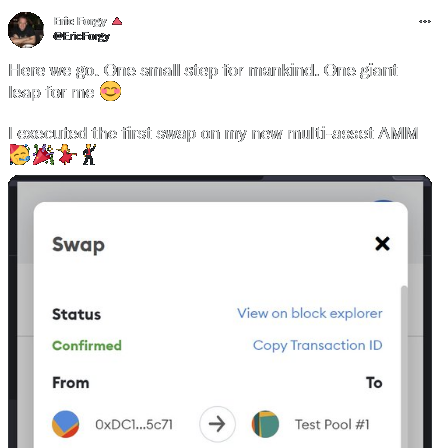

From there, I built a frontend and executed the first multiswap on May 5:

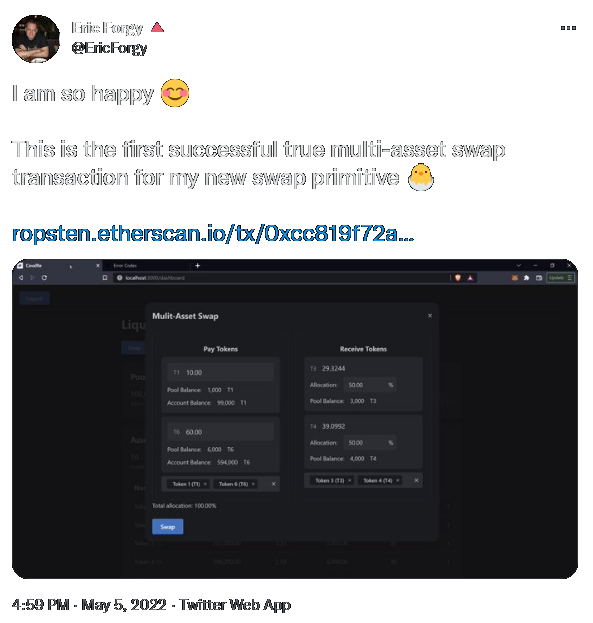

The testnet alpha was deployed and made available publicly on May 13:

I gave my first public presentation with a demo of the testnet alpha to the Remix Bay Area meetup on May 24:

Some additional recent milestones includes:

- On June 13, we deployed our first real landing page.

- On June 21, we deployed the first version of the documentation.

- On June 25, after consulting our Discord community, we decided to focus our attention on launching on Avalanche.

- On July 13, I deployed a significantly improved frontend with a consistent look and feel with our landing page.

- On July 15-16, I attended Avalanche House in Brooklyn.

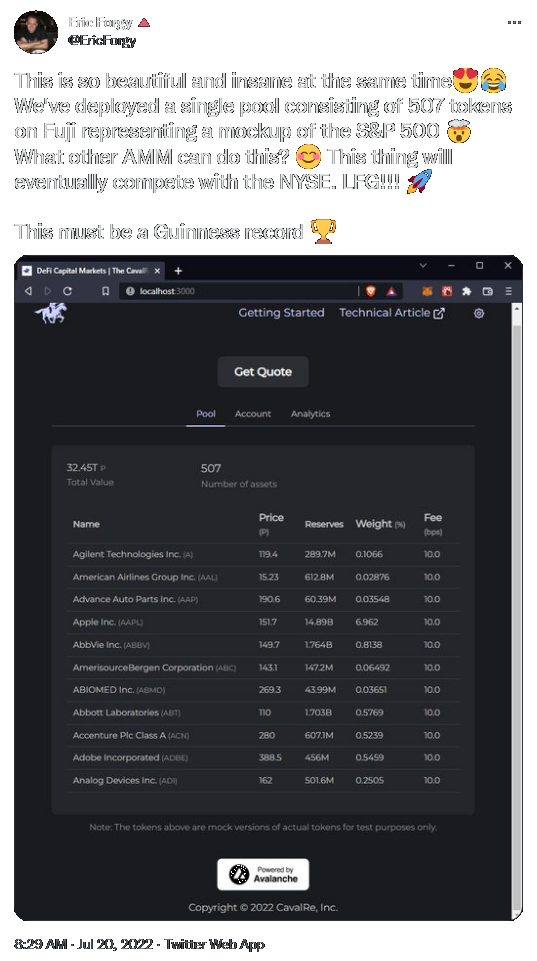

- On July 20, we deployed a first-of-its-kind proof-of-concept 507-token AMM pool representing a mockup of the S&P 500 to Fuji.

- On July 23, we deployed an improved frontend allowing users to switch among pools.

The Vision

This is already a mega long article, but I do want to close out with a word about our vision. I spent close to 10 years working in traditional finance (TradFi) at some of the top global financial institutions trying to fix things from the inside, but ultimately came to the conclusion that TradFi cannot be fixed. We need to start over. The last 8 years, I've been trying to build new financial services done right from the beginning, but I was still missing the point and trying to build on the same old broken rails as TradFi. It wasn't until CavalRe 2.0 that I finally embraced DeFi. I truly believe the future of capital markets is onchain and I am excited to a part of making that happen.

The AMM we are preparing to launch on Avalanche now is just the beginning. In CavalRe 1.0 above, I explained the genesis of the idea for self-financing market makers (SFMMs) came about from thinking about risk transfer and reinsurance. I always say that I love insurance because it is complicated enough that if you solve insurance, you solve everything. With insurance, you are dealing with contingent future cashflows. Contingent future cashflows are the lifeblood of TradFi fixed income, but barely exist onchain today. This is a trillion dollar opportunity. In fact, starting with the AMM we are launching now, which is already a trillion dollar opportunity, until we get back to reinsurance, we will pass through several other trillion dollar opportunities including futures and options. The roadmap is clear and it is beautiful.

LFG!!! 🚀🚀🚀